Benefit From Our Best-In-Class Approach And Proven Strategies

What is an Accounts Payable (AP) Recovery Audit? It is a historical or real-time review of your Accounts Payable transactions to identify erroneous overpayments and under-deductions made to your suppliers. The areas of an Accounts Payable Recovery Audit include duplicate payments, supplier credits, payment terms, accruals, rebates, allowances, pricing, contract terms, transportation, escheatment, fraud detection, real estate leases, among others.

Accounts Payable Recovery Audits are 100% Contingency based.

What does every Accounts Payable Recovery Audit entail?

Our best-in-class approach to any AP Recovery Audit engagement begins with an effective recovery audit project plan that is developed in collaboration with our customer’s client’s specifications.

Your Dedicated Team With A Proven Process

Each engagement is assigned a Managing Director that is responsible for all components of the AP Recovery Services. A team is assigned including all US based employees of SAS. Every project has dedicated staffing to ensure an efficient audit with industry experienced auditors.

Our Project Plan, Your Piece Of Mind

At the beginning of every Accounts Payable Recovery Audit, SAS will conduct a Kick-Off Meeting with our client to establish and outline a comprehensive project plan. Our project plan is designed to minimize our client’s involvement and time commitment. The plan will detail each step of the Accounts Payable audit process, recommended approach, scope, deliverables, and timelines. This preliminary audit plan will include:

- Review Accounts Payable audit objectives

- Client’s objectives for the engagement

- Data requirements

- Roles and responsibilities

- Scope of work

- Approach and deliverables for each recovery claim category

- Claim submission and approval process

- Communications schedule and Reporting

SAS will deliver reporting based on client specific directives, providing updates of recovery audit status and key indicators as agreed upon during the Kick-Off meeting.

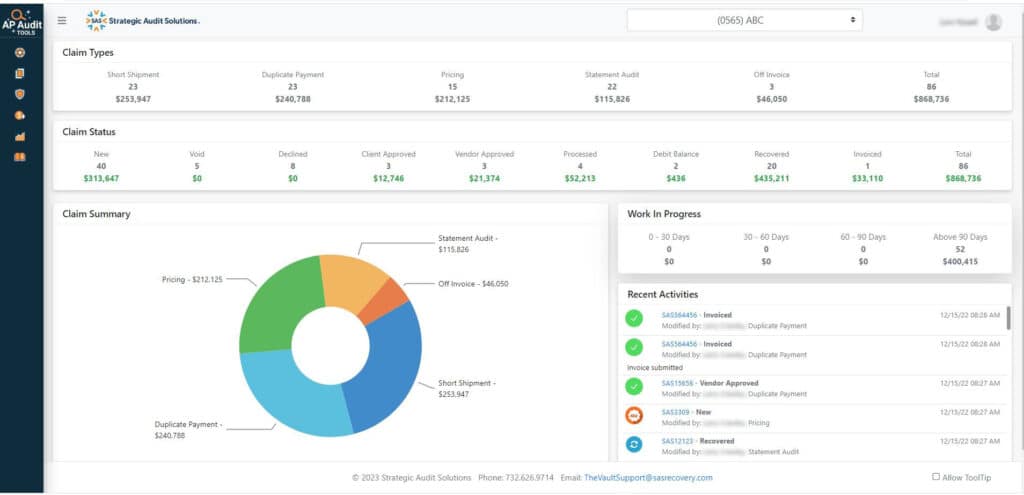

SAS’ proprietary web-based Claims Approval System – The Vault, will be utilized throughout the Accounts Payable Recovery Audit engagement to monitor and track claim production, supplier & internal communications and real-time reporting

At the conclusion of the engagement, we will deliver our Accounts Payable Audit Report detailing our findings and recommendations for improvements to your systems and controls to avoid future leakage.

We also provide value added reporting for many of our clients which will provide greater insight into their Accounts Payable environment. These reports are customized based upon client specific needs.

See what our clients say...

SAS Insights

The Importance of Maintaining a Clean Vendor Master File

The Importance of Maintaining a Clean Vendor Master File The vendor master file is a cornerstone of accounts payable operations and plays a crucial role in maintaining financial integrity and […]

Continue Reading

Mastering Duplicate Payment Prevention

Introduction In the intricate landscape of Accounts Payable, one of the most insidious threats lurking in the shadows is that of duplicate payments. These seemingly innocent errors can have far-reaching […]

Continue Reading

Revolutionizing Accounts Payable: The Rise of AP Audit Tools in the Next Generation of Recovery Auditing

The Accounts Payable (AP) Recovery Audit industry emerged decades ago to address over-payments, over-charges, and accounting errors in medium and large-sized companies. Due to the high volume of transactions, companies […]

Continue Reading

Maximizing Financial Health: The Crucial Role of AP Recovery Audits for Healthcare Supply Chain Leaders

In the intricate world of healthcare supply chains, where precision and reliability are paramount, the Accounts Payable (AP) process plays a critical role. One often underestimated strategy for enhancing supplier […]

Continue Reading